Income Tax Alert: Urgent notice of income tax to PAN card holders, may have to pay fine up to Rs - 10,000

|

| Income Tax Alert: Urgent notice of income tax to PAN card holders, may have to pay fine up to Rs - 10,000 |

What is Income Tax Department?

The Income Tax Department is a government agency responsible for collecting direct taxes from individuals and businesses. In India, it operates under the Department of Revenue, Ministry of Finance. The primary function of the department is to ensure compliance with tax laws and regulations, as well as to detect and deter tax evasion. The department administers various provisions of the Income Tax Act, such as the assessment of taxable income, collection of taxes, and investigation and prosecution of tax evaders. The department also provides assistance and guidance to taxpayers regarding tax laws and procedures, and resolves any disputes related to taxation The department operates through a network of regional and local offices across the country, and also has an online portal for filing tax returns and other related services.

Relation Between Income tax & PAN Card?

The Permanent Account Number

(PAN) is a unique 10-digit alphanumeric code assigned to every taxpayer in India by the Income Tax Department. The PAN card is an identification document that contains the PAN and is required for several financial transactions, including filing income tax returns.

Income tax is a tax levied by the government on the income earned by individuals, companies, and other entities. The income tax department uses the

PAN to track and monitor the income and tax liability of taxpayers. It is mandatory for every taxpayer to quote their PAN on their income tax returns, and the absence of PAN can lead to penalties and legal implications.

Therefore, PAN card is an essential document for income tax purposes in India. It is required for filing income tax returns, applying for a tax deduction at source

(TDS) certificate, and various other financial transactions like opening a bank account, buying mutual funds, and shares, etc.

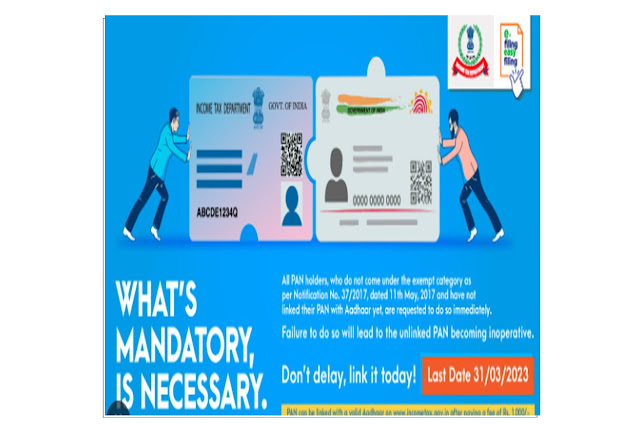

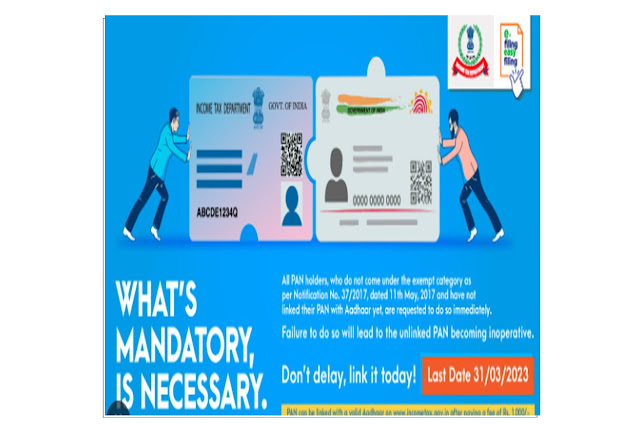

Urgent Notice of Income tax to PAN card holders 2023?

The Income Tax Departmenthas said that in casethe PAN card is not Linked to Aadhaar, from April 1, 2023, your

PAN will ber canceled under the Section 139AA of the Income Tax Act. After this

PAN card Cannot be Used.

According to the Income tax Act, there is the provision to impose a fine of Rs 10,000 for using an inactive PAN Card. Therefore, those who have PAN card and are not eligible for the exemption given by income Tax, they will have to link it before March 31, 2023

According to the Income Tax Department, till July 1, 2022, the Process of Linking

PAN with Aadhaar has been free. But, after July, now the Deadline to link PAN has been extended till March 31, 2023 and for this PAN holders will have to ay Rs 1000 as late fee.

|

| Income Tax Alert: Urgent notice of income tax to PAN card holders, may have to pay fine up to Rs - 10,000 |

Linking your PAN card to Aadhaar card is a simple process and can be done in the following ways:

Online method:

b. Click on the

"Link Aadhaar" option on the left-hand side of the homepage.

c. Enter your

PAN, Aadhaar number, name as per Aadhaar and Captcha code.

d. Click on the "Link Aadhaar" button.

e. Once the details are verified, your PAN and Aadhaar will be linked.

SMS method:

a. Type UIDPAN<SPACE><12-digit Aadhaar number><SPACE><10-digit PAN> and send it to either 567678 or 56161 from your registered mobile number.

b. If the Aadhaar and PAN details match, your PAN and Aadhaar will be linked.

Income Tax Department's e-filing portal:

a. Log in to the Income Tax Department's e-filing portal.

b. Go to the "Profile Settings" option and click on "

Link Aadhaar".

d. If the details match, your PAN and Aadhaar will be linked.

It is important to ensure that the details on your

PAN and Aadhaar cards match, including your name, date of birth, and gender. If there is any mismatch, you will need to get it corrected before attempting to link your PAN and Aadhaar.

0 Comments