How to Open Business Account - Tide Business Account Benefits - How to open tide Business Account.

|

| How to Open Business Account - Tide Business Account Benefits - How to open tide Business Account. |

FREE Business Account Open Link: Click Here

How to make a FREE Business A/c Online Click Here

What is Tide Business?

the Tide business account, it is a digital banking solution designed for small businesses in the UK.

The Tide business account allows business owners to manage their finances easily and efficiently through a mobile app or web interface. Some of its features include the ability to send and receive payments, manage expenses, track invoices, and more.

Tide Business also offers other services for small businesses, such as access to loans and credit facilities, tax and accounting support, and insurance products.

Features of Tide Business ?

|

| How to Open Business Account - Tide Business Account Benefits - How to open tide Business Account. |

Tide Business is a UK-based digital banking platform that offers business accounts to small and medium-sized enterprises (SMEs). Some of the features of Tide Business account include:

1.Easy account opening: You can open a Tide Business account in just a few minutes, without the need for any paperwork or branch visits.

2.Simple pricing: Tide Business offers a transparent and straightforward pricing structure, with no hidden fees or charges.

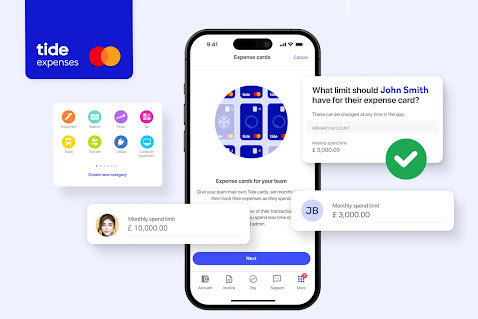

3.Mastercard debit card: You will receive a free Mastercard debit card that can be used to make purchases online and in-store, as well as withdraw cash from ATMs.

4.Mobile app: The Tide Business mobile app allows you to manage your account on-the-go, including viewing transactions, sending and receiving payments, and depositing cheques.

5.Integration with accounting software: Tide Business integrates with popular accounting software like Xero and FreeAgent, making it easy to manage your finances and keep track of your expenses.

6.Multiple users: You can add multiple users to your Tide Business account, with different levels of access and permissions.

7.Invoicing: Tide Business allows you to create and send professional invoices, track payments, and set up automatic reminders for unpaid invoices.

8.Customer support: Tide Business offers customer support via phone, email, and live chat, with extended hours of operation.

These are just some of the features that Tide Business offers. Depending on your specific needs, you may find other features that are relevant to you as well.

Is Tide Business Account is Free?

Tide is a UK-based digital banking service that offers business accounts to small and medium-sized enterprises. Tide offers both free and paid business accounts, depending on the features and services you require.

Tide's free business account comes with basic features such as online banking, invoicing, expense tracking, and integration with accounting software. However, there are limits on the number of transactions you can make per month, and you may be charged for additional services such as cash withdrawals or international transfers.

Tide also offers paid plans with additional features such as unlimited transactions, priority customer support, and multi-user access. The pricing for these plans varies depending on the level of service you require.

It's worth noting that Tide's pricing and features are subject to change, so it's a good idea to check their website or contact their customer service team for the most up-to-date information.

Is Tide Business Bank Is Safe?

As an AI language model, I cannot provide a definitive answer on the safety of a specific bank. However, it is generally recommended to do thorough research on any bank you are considering using, especially with regards to its safety and security measures.

That being said, Tide is a UK-based business banking provider regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). Tide uses industry-standard security measures to protect its customers' funds and personal information, such as two-factor authentication and encryption.

It is important to note that no bank can guarantee 100% safety and security. However, using a regulated and reputable banking provider with strong security measures in place can help reduce the risks associated with banking. It may be helpful to review Tide's terms and conditions, privacy policy, and other related information to understand their specific policies and procedures.

FREE Business Account Open Link: Click Here

How to make a FREE Business A/c Online Click Here

What are the Benefits of Tide Business Account?

Tide is a UK-based digital banking platform that offers business accounts to small and medium-sized enterprises (SMEs). The benefits of a Tide business account include:

1.Easy account opening: With Tide, you can open a business account in minutes, without the need for lengthy paperwork or visiting a bank branch.

2.No monthly fees: Tide does not charge monthly account fees for its business accounts, which can save you money in the long run.

3.Quick and easy payments: Tide allows you to make payments to suppliers, employees, and other businesses quickly and easily, using its mobile app or online banking platform.

4.Instant notifications: You will receive instant notifications whenever money is paid into or out of your account, which can help you keep track of your finances in real-time.

5.Integration with accounting software: Tide integrates with popular accounting software such as Xero, QuickBooks, and FreeAgent, which can make it easier to manage your finances.

6.Contactless debit card: Tide provides a Mastercard debit card that you can use to make payments and withdraw cash from ATMs.

7.Free cash deposits: You can deposit cash into your Tide business account for free at any Post Office branch in the UK.

Overall, Tide's business account offers a range of features and benefits that can help SMEs manage their finances more efficiently and cost-effectively.

Can I have 2 Business Account with Tide?

Tide allowed individuals to open multiple business accounts. It's important to note that banking policies and offerings may change over time, so it's best to consult Tide's official website or contact their customer support directly for the most up-to-date information on opening multiple business accounts.

Does Tide Pay Interest?

Tide did not offer interest on its business current accounts. However, banking services and features can change over time, so it's always a good idea to check with the official Tide website or contact their customer support directly to get the most up-to-date information on their offerings, including any interest-related services.

How to Open Business Account?

Opening a business account typically involves several steps to ensure you have the necessary documentation and meet the requirements set by the financial institution. Here's a general guide on how to open a business account:

1.Determine the type of account: Research different types of business accounts offered by banks and choose the one that best suits your business needs. Common options include business checking accounts, savings accounts, and merchant accounts.

2.Choose a financial institution: Research and compare various banks or credit unions to find the one that offers the services, features, and benefits that align with your business requirements. Consider factors such as fees, account features, online banking capabilities, and customer support.

3.Gather required documents: Prepare the necessary documents required by the financial institution to open a business account. Typical documents include:

4.Business identification documents: Business license, Articles of Incorporation, partnership agreement, or a Doing Business As (DBA) certificate.

5.Employer Identification Number (EIN): Obtain an EIN from the Internal Revenue Service (IRS) if your business is required to have one.

6.Identification documents: Personal identification such as driver's license, passport, or Social Security Number (SSN) for each account signatory or owner.

7.Business address verification: Utility bills or lease agreements that confirm your business address.

8.Business banking resolution: If your business has multiple owners or authorized signatories, you may need a banking resolution document stating who has the authority to open and manage the account.

9.Schedule an appointment or apply online: Contact the chosen financial institution to schedule an appointment with a business account representative, or check if they offer an online application process. Some banks allow you to start the application online and complete it in person.

10.Complete the application: Fill out the required application form accurately and provide all the necessary information. This typically includes details about your business, such as name, address, contact information, ownership structure, and nature of business activities.

11.Submit the required documentation: Provide the required documents along with the completed application. Depending on the bank, you may need to provide physical copies or upload digital copies through their online portal.

12.Deposit funds: Some banks may require an initial deposit to open a business account. Prepare the necessary funds and be ready to deposit them during the account opening process.

13.Review the terms and conditions: Carefully review the terms and conditions, fee schedules, and any associated service agreements provided by the bank. Ensure you understand the charges, transaction limits, and other account-related details.

14.Activate the account: Once your application is approved, the bank will provide you with the account details, including your account number, routing number, and any required debit cards or checks. Activate your account according to the instructions provided.

It's important to note that the exact process may vary slightly depending on the financial institution and your location. It's always recommended to contact your chosen bank directly or visit their website to get specific instructions and requirements for opening a business account.

How to open tide Business Account?

To open a Tide Business Account, you can follow these general steps:

1.Visit the Tide website: Go to the official website of Tide, the digital business banking platform. Make sure you are on the correct website to avoid any scams or fraudulent websites.

2.Sign up: Look for the "Sign Up" or "Open an Account" button on the Tide homepage and click on it. This will start the account opening process.

3.Provide information: You'll be asked to provide various details about yourself and your business. This may include your name, contact information, business name, business structure (e.g., sole trader, limited company), business address, and other relevant information.

4.Verify your identity: As part of the account opening process, you'll need to go through an identity verification procedure. This typically involves providing personal identification documents such as your passport or driver's license. You may also need to provide additional documents depending on your business structure.

5.Confirm business details: You might be required to provide further information about your business, such as its purpose, industry, projected turnover, and any relevant supporting documents like business plans or financial statements.

6.Review terms and conditions: Take the time to read and understand the terms and conditions, as well as any associated fees or charges for the Tide Business Account. It's important to be aware of the account features and limitations before proceeding.

6.Submit your application: Once you have provided all the necessary information and agreed to the terms and conditions, submit your application for review.

7.Wait for approval: The Tide team will review your application, and if everything is in order, your account will be approved. You will typically receive an email or notification regarding the status of your application.

8.Fund your account: Once your account is approved, you can fund it by transferring money from another bank account or depositing funds through various methods supported by Tide.

It's important to note that the account opening process may vary slightly depending on your location and the specific requirements of Tide. Make sure to visit the official Tide website and follow their instructions for accurate and up-to-date information.

How to Work With Tide Business Account?

To work with a Tide business account, you can follow these steps:

1.Sign up for an account: Visit the Tide website and sign up for a business account. Provide the necessary information and complete the registration process.

2.Verify your identity: Tide will require you to verify your identity and provide certain documents. This may include uploading identification documents and proof of address.

3.Set up your account: Once your identity is verified, you can set up your Tide business account. This typically involves providing information about your business, such as its name, type, and address.

4.Fund your account: To start using your Tide business account, you'll need to deposit funds into it. You can do this by transferring money from another bank account or through other supported methods.

5.Manage your transactions: With your Tide business account set up and funded, you can now manage your transactions. Use the Tide mobile app or web interface to view your account balance, make payments, send invoices, and track your expenses.

6.Integrate with accounting software: Tide integrates with popular accounting software, such as Xerox and Quick Books, making it easier to manage your finances. You can connect your Tide account with these platforms to synchronize your transactions and streamline your accounting processes.

7.Access additional features: Tide offers various additional features to help manage your business finances. These may include features like multi-user access, expense categorization, tax calculations, and financial insights. Explore the Tide platform to take advantage of these features based on your business needs.

8.Support and assistance: If you have any questions or encounter issues while working with Tide, you can reach out to their customer support team. They can provide guidance and assistance to resolve any queries or problems you may have.

Remember to familiarize yourself with Tide's terms and conditions, fees, and other policies to ensure you have a clear understanding of how to use the account effectively.

Do you Get a Debit Card With Tide Business Account?

Yes, when you open a business account with Tide, you will receive a debit card associated with that account. Tide is a financial technology company that provides business banking services primarily aimed at small businesses and freelancers. Their business accounts come with a range of features, including a debit card, to help manage business finances more effectively.

The Tide debit card can be used for various purposes, such as making purchases, withdrawing cash from ATMs, and conducting online transactions. It is linked to your Tide business account, allowing you to access and manage your funds easily. The card can be used both domestically and internationally, depending on the terms and conditions set by Tide.

It's worth noting that specific features and offerings of the Tide business account, including the debit card, may have evolved or changed since my knowledge. To obtain the most accurate and up-to-date information, I recommend visiting the official Tide website or contacting their customer support.

Reviews of Tide Business Account ?

Tide is a UK-based online banking platform that offers a business account specifically designed for small and medium-sized enterprises (SMEs). However, please note that my information might be outdated, and it's always a good idea to refer to the most recent reviews and information available.

Overall, Tide has received mixed reviews from its users. Here are some common points mentioned in reviews:

1.Ease of Use: Many users appreciate the user-friendly interface and the simplicity of opening and managing a business account with Tide. The account can be set up quickly, often within minutes, without the need for extensive paperwork.

2.Account Features: Tide offers various features tailored for small businesses, including invoicing tools, expense categorization, and integration with accounting software. Some users find these features helpful in managing their finances efficiently.

3.Customer Service: There have been mixed opinions about the quality of customer service provided by Tide. Some users report positive experiences with helpful and responsive support, while others have expressed dissatisfaction with delayed responses or difficulty in resolving issues.

4.Fees and Pricing: Tide has a transparent fee structure, but some users have found the pricing to be higher compared to traditional banks or other alternative online banking solutions. It's important to review the fee schedule and compare it with other options to determine if it aligns with your business needs.

5.Reliability and Stability: While some users have not encountered any issues with Tide's service, others have experienced occasional glitches, technical difficulties, or delays in transactions. It's advisable to consider the overall stability and reliability of the platform when assessing its suitability for your business.

Since the information I have is not up-to-date, I recommend visiting Tide's official website and searching for recent user reviews to get the most accurate and current feedback from other business owners who have used their services. It's also beneficial to compare Tide with other business banking options available to ensure you find the best fit for your specific requirements.

0 Comments