|

| How to Open Paytm Money Demat Account - Paytm Money Account Opening Process - Paytm Money Demat Account Charges. |

About Paytm New Services -

As an AI language model, my knowledge is based on information available up until September 2021. Therefore, I might not have specific details about the latest developments or services introduced by Paytm after that date. However, I can provide general information about Paytm and some of its existing services.

Paytm is a digital payment platform based in India. It was founded in 2010 and has since grown to become one of the leading payment service providers in the country. Paytm offers a wide range of services, including mobile recharge, bill payments, ticket bookings, money transfers, and online shopping.

Here are some of the key services that Paytm has been known for:

1.Digital Wallet: Paytm initially gained popularity for its digital wallet service, which allows users to store money and make cashless transactions for various purposes, such as mobile recharge, bill payments, and online shopping.

2.UPI Payments: Paytm supports Unified Payments Interface (UPI), which enables users to link their bank accounts and make seamless money transfers directly from their bank to other accounts.

3.Paytm Payments Bank: Paytm also operates a payments bank, which provides basic banking services such as savings accounts, debit cards, and online banking facilities. Users can open a Paytm Payments Bank account through the Paytm app.

4.Paytm Mall: Paytm has an online shopping platform called Paytm Mall, where users can browse and purchase a wide range of products, including electronics, fashion, home appliances, and more.

5.Paytm Postpaid: Paytm introduced a "Paytm Postpaid" service, allowing eligible customers to avail instant credit and make purchases on Paytm and partner platforms. The credit can be repaid later within the specified period.

Please note that Paytm frequently updates and introduces new services to cater to evolving user needs. To get the most up-to-date information on Paytm's new services, I recommend visiting their official website or checking the latest news related to Paytm.

Paytm Money Demat Account -

Paytm Money is a popular financial services platform in India that offers various investment and wealth management services. One of the services provided by Paytm Money is the Paytm Money Demat Account.

A Demat Account, short for Dematerialized Account, is an electronic account that holds shares and securities in a digital format. It eliminates the need for physical share certificates and allows investors to buy, sell, and hold securities electronically.

With the Paytm Money Demat Account, users can open a digital Demat Account with the convenience of a few simple steps through the Paytm Money app or website. Here are some key features and benefits of the Paytm Money Demat Account:

Seamless Integration: The Paytm Money Demat Account is seamlessly integrated with the Paytm Money app, making it easy for users to manage their investments and track their portfolio in one place.

Paperless Account Opening: Opening a Paytm Money Demat Account is a paperless process. Users can complete the KYC (Know Your Customer) verification online, eliminating the need for physical documentation.

Access to Multiple Asset Classes: The Demat Account allows users to invest in various asset classes, including stocks, mutual funds, exchange-traded funds (ETFs), initial public offerings (IPOs), and more.

Real-time Trading: Users can execute trades in real-time, buying and selling stocks or other securities directly from their Paytm Money Demat Account.

Research and Analysis: Paytm Money provides users with research tools and analysis to help make informed investment decisions. Users can access company information, financials, historical data, expert recommendations, and more.

Track and Monitor Portfolio: The Paytm Money app offers portfolio tracking and monitoring features, allowing users to keep track of their investments' performance and receive personalized insights.

Investor Education: Paytm Money provides educational resources and content to help investors enhance their knowledge and make informed investment choices.

It's important to note that the features and services offered by Paytm Money are subject to change, and it's advisable to visit the official Paytm Money website or contact their customer support for the most up-to-date and accurate information regarding their Demat Account offering.

Paytm Money Account Opening Process -

|

| How to Open Paytm Money Demat Account - Paytm Money Account Opening Process - Paytm Money demat account Charges |

To open a Paytm Money account, you can follow these steps:

Download the Paytm Money app: Visit the Google Play Store (for Android users) or the Apple App Store (for iOS users) and download the Paytm Money app.

Install and open the app: Once the app is downloaded, install it on your device and open it.

Sign up: On the app's home screen, you'll find the option to sign up. Click on it to begin the account opening process.

Enter your mobile number: Provide your mobile number, which will be verified with an OTP (One-Time Password).

Complete the KYC process: You will need to complete the KYC (Know Your Customer) process to open a Paytm Money account. You have two options for KYC:

a. Aadhaar-based KYC: If you choose this option, you will need to enter your Aadhaar number and verify it using OTP. You will also need to provide your PAN (Permanent Account Number) and personal details for verification.

b. Manual KYC: If you don't have an Aadhaar number or prefer not to use it, you can opt for manual KYC. You will need to provide your PAN, personal details, and upload relevant documents like a photograph and address proof.

Enter personal details: After completing the KYC process, you will be prompted to enter your personal details such as name, date of birth, and email address.

Set up a password: Create a strong password for your Paytm Money account. Make sure to choose a unique password and keep it secure.

Complete risk profile assessment: Paytm Money will ask you a series of questions to assess your risk profile. Based on your answers, the app will recommend suitable investment options for you.

Bank account linking: Link your bank account with Paytm Money to facilitate seamless transactions. You will need to provide your bank account details and verify them through the app.

E-signature: In order to complete the account opening process, you may need to provide your e-signature. This is done electronically within the Paytm Money app.

Start investing: Once your Paytm Money account is successfully opened, you can start exploring various investment options available on the platform. You can invest in mutual funds, stocks, and other investment instruments.

It's important to note that the account opening process may be subject to change, and Paytm Money may require additional documents or information based on regulatory requirements. Make sure to follow the instructions provided by Paytm Money during the account opening process for the most up-to-date informationTo open a Paytm Money account, you can follow these steps:

Download the Paytm Money app: Visit the Google Play Store (for Android users) or the Apple App Store (for iOS users) and download the Paytm Money app.

Install and open the app: Once the app is downloaded, install it on your device and open it.

Sign up: On the app's home screen, you'll find the option to sign up. Paytm Money Click on it to begin the account opening process.

Enter your mobile number: Provide your mobile number, which will be verified with an OTP (One-Time Password).

Complete the KYC process: You will need to complete the KYC (Know Your Customer) process to open a Paytm Money account. You have two options for KYC:

a. Aadhaar-based KYC: If you choose this option, you will need to enter your Aadhaar number and verify it using OTP. You will also need to provide your PAN (Permanent Account Number) and personal details for verification.

b. Manual KYC: If you don't have an Aadhaar number or prefer not to use it, you can opt for manual KYC. You will need to provide your PAN, personal details, and upload relevant documents like a photograph and address proof.

Enter personal details: After completing the KYC process, you will be prompted to enter your personal details such as name, date of birth, and email address.To open a Paytm Money account, you can follow these steps:

Download the Paytm Money app: Visit the Google Play Store (for Android users) or the Apple App Store (for iOS users) and download the Paytm Money app.

Install and open the app: Once the app is downloaded, install it on your device and open it.

Sign up: On the app's home screen, you'll find the option to sign up. Click on it to begin the account opening process.

Enter your mobile number: Provide your mobile number, which will be verified with an OTP (One-Time Password).

Complete the KYC process: You will need to complete the KYC (Know Your Customer) process to open a Paytm Money account. You have two options for KYC:

a. Aadhaar-based KYC: If you choose this option, you will need to enter your Aadhaar number and verify it using OTP. You will also need to provide your PAN (Permanent Account Number) and personal details for verification.

b. Manual KYC: If you don't have an Aadhaar number or prefer not to use it, you can opt for manual KYC. You will need to provide your PAN, personal details, and upload relevant documents like a photograph and address proof.

Enter personal details: After completing the KYC process, you will be prompted to enter your personal details such as name, date of birth, and email address.

Set up a password: Create a strong password for your Paytm Money account. Make sure to choose a unique password and keep it secure.

Complete risk profile assessment: Paytm Money will ask you a series of questions to assess your risk profile. Based on your answers, the app will recommend suitable investment options for you.

Bank account linking: Link your bank account with Paytm Money to facilitate seamless transactions. You will need to provide your bank account details and verify them through the app.

E-signature: In order to complete the account opening process, you may need to provide your e-signature. This is done electronically within the Paytm Money app.

Start investing: Once your Paytm Money account is successfully opened, you can start exploring various investment options available on the platform. You can invest in mutual funds, stocks, and other investment instruments.

It's important to note that the account opening process may be subject to change, and Paytm Money may require additional documents or information based on regulatory requirements. Make sure to follow the instructions provided by Paytm Money during the account opening process for the most up-to-date informationTo open a Paytm Money account, you can follow these steps:

Download the Paytm Money app: Visit the Google Play Store (for Android users) or the Apple App Store (for iOS users) and download the Paytm Money app.

Install and open the app: Once the app is downloaded, install it on your device and open it.

Sign up: On the app's home screen, you'll find the option to sign up. Click on it to begin the account opening process.

Enter your mobile number: Provide your mobile number, which will be verified with an OTP (One-Time Password).

Complete the KYC process: You will need to complete the KYC (Know Your Customer) process to open a Paytm Money account. You have two options for KYC:

a. Aadhaar-based KYC: If you choose this option, you will need to enter your Aadhaar number and verify it using OTP. You will also need to provide your PAN (Permanent Account Number) and personal details for verification.

b. Manual KYC: If you don't have an Aadhaar number or prefer not to use it, you can opt for manual KYC. You will need to provide your PAN, personal details, and upload relevant documents like a photograph and address proof.

Enter personal details: After completing the KYC process, you will be prompted to enter your personal details such as name, date of birth, and email address.

Set up a password: Create a strong password for your Paytm Money account. Make sure to choose a unique password and keep it secure.

Complete risk profile assessment: Paytm Money will ask you a series of questions to assess your risk profile. Based on your answers, the app will recommend suitable investment options for you.

Bank account linking: Link your bank account with Paytm Money to facilitate seamless transactions. You will need to provide your bank account details and verify them through the app.

E-signature: In order to complete the account opening process, you may need to provide your e-signature. This is done electronically within the Paytm Money app.

Start investing: Once your Paytm Money account is successfully opened, you can start exploring various investment options available on the platform. You can invest in mutual funds, stocks, and other investment instruments.

It's important to note that the account opening process may be subject to change, and Paytm Money may require additional documents or information based on regulatory requirements. Make sure to follow the instructions provided by Paytm Money during the account opening process for the most up-to-date information

Set up a password: Create a strong password for your Paytm Money account. Make sure to choose a unique password and keep it secure.

Complete risk profile assessment: Paytm Money will ask you a series of questions to assess your risk profile. Based on your answers, the app will recommend suitable investment options for you.

Bank account linking: Link your bank account with Paytm Money to facilitate seamless transactions. You will need to provide your bank account details and verify them through the app.

E-signature: In order to complete the account opening process, you may need to provide your e-signature. This is done electronically within the Paytm Money app.

Start investing: Once your Paytm Money account is successfully opened, you can start exploring various investment options available on the platform. You can invest in mutual funds, stocks, and other investment instruments.

It's important to note that the account opening process may be subject to change, and Paytm Money may require additional documents or information based on regulatory requirements. Make sure to follow the instructions provided by Paytm Money during the account opening process for the most up-to-date information.

Paytm Money Demat account Charges -

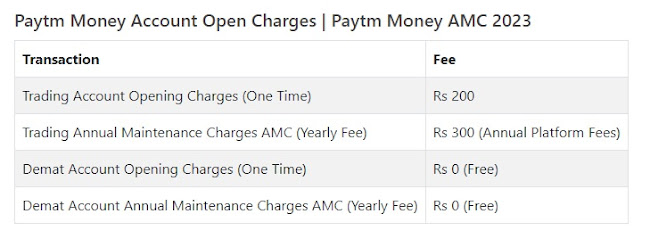

Paytm Money offers stock trading account and Demat account services. Customer pays the fees, commission and taxes while trading with Paytm Money. Paytm Money fee structure and trading commission rates are explained as below.

To open Paytm Money account you have to pay account opening charges and annual maintenance charges (AMC).

|

| How to Open Paytm Money Demat Account - Paytm Money Account Opening Process - Paytm Money demat account Charges |

Paytm Money Brokerage Charges 2023

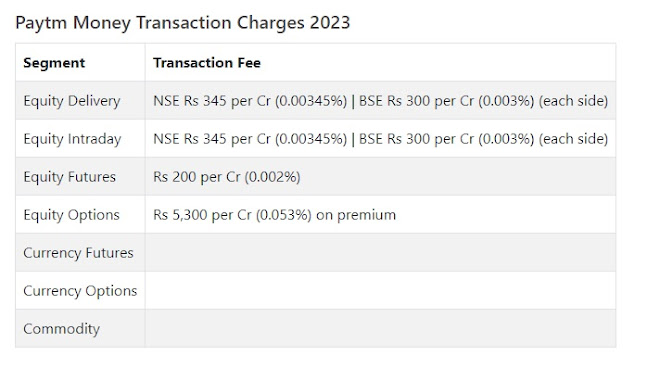

Customer pays a commission (brokerage) when buying or selling stocks through Paytm Money. The brokerage charges for equity, commodities and currency derivative trading for Paytm Money are explained as below.

|

| How to Open Paytm Money Demat Account - Paytm Money Account Opening Process - Paytm Money demat account Charges |

Paytm Money Transaction Charges -

A combination of Exchange Turnover Charge and Trade Clearing Charge. Know more about Transaction Charges.

|

| How to Open Paytm Money Demat Account - Paytm Money Account Opening Process - Paytm Money demat account Charges |

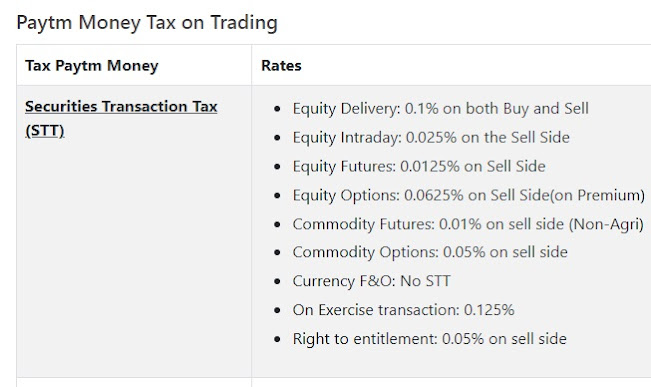

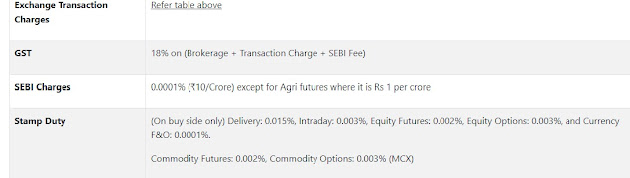

Paytm Money Trading Taxes -

Paytm Money charges government taxes and fees in addition to the brokerage. These Paytm Money trading taxes are shows in the contract note sent to the customer at the end of the day. The below table can be used for the Paytm Money tax calculation.

How to Open Paytm Money Demat Account - Paytm Money Account Opening Process - Paytm Money demat account Charges

|

|

| How to Open Paytm Money Demat Account - Paytm Money Account Opening Process - Paytm Money demat account Charges |

Paytm Money Demat Account Profit & loss -

A Demat Paytm trading account is used for holding and trading securities in an electronic format. It allows investors to buy, sell, and hold various financial instruments like stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The profit or loss in a Demat trading account depends on the performance of the securities held within the account.

To calculate the profit or loss in a Demat trading account, you need to consider the following factors:

1.Buying Price: The price at which you purchased the securities.

2.Selling Price: The price at which you sold the securities.

3.Quantity: The number of securities bought or sold.

4.Brokerage Charges: The fees charged by the broker for executing the trades.

5.Taxes and Duties: Applicable taxes and duties, such as Securities Transaction Tax (STT), Goods and Services Tax (GST), etc.

To calculate the profit or loss from a specific transaction, you can use the following formula:

Profit/Loss = (Selling Price - Buying Price) * Quantity - Brokerage Charges - Taxes and Duties

If you want to calculate the overall profit or loss in your Demat trading account, you need to consider the cumulative effect of all your transactions. Add up the profits and losses from each transaction, including the brokerage charges and taxes, to get the net profit or loss.

It's important to note that the profit or loss in a Demat trading account is realized only when you sell the securities. Until then, any fluctuations in the market value of the securities will affect the unrealized gains or losses in your account.

To get an accurate calculation of your profit or loss, you should consult with your broker or use the online trading platform provided by your broker. They usually provide detailed reports and statements that give you an overview of your trading activity, including the profit or loss incurred.

0 Comments