Pan Card Aadhar Card Link - Pan Aadhar Link Last Date - How to Link Aadhar to Pan - If we Not link Pan with Aadhar - Pan Aadhar Link

|

| Pan card Aadhar card Link - Pan Aadhar Link Last date - How to Link Aadhar to Pan - if we Not link Pan with Aadhar -pan aadhar link |

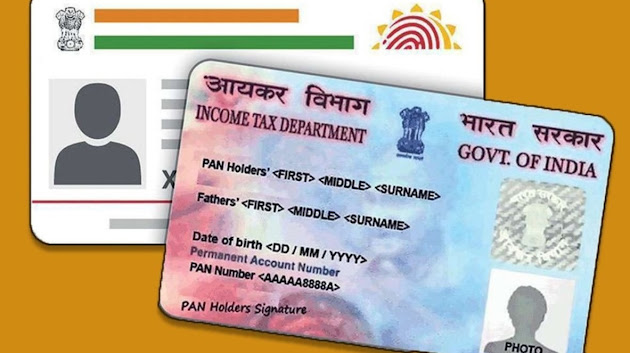

About Pan Card & Aadhar Card -

PAN Card and Aadhaar Card are two important identification documents used in India. Here's some information about each of them:

PAN Card (Permanent Account Number):

1.PAN Card is a unique 10-character alphanumeric identifier issued by the Income Tax Department of India.

2.It is primarily used for financial transactions, such as filing income tax returns, opening bank 3.accounts, investing in securities, and conducting business transactions.

4.PAN Card helps the government track taxable transactions and prevent tax evasion.

5.It contains information like the individual's name, date of birth, photograph, and a unique PAN number.

6.PAN Card is issued to individuals, companies, and entities eligible to pay taxes in India.

7.To obtain a PAN Card, one needs to apply to the Income Tax Department or through authorized agencies. The application requires specific documents and fees.

Aadhaar Card:

1.Aadhaar Card is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI).

2.It serves as a proof of identity and address for Indian residents.

3.Aadhaar Card contains biometric and demographic information, including fingerprints, iris scans, photograph, name, date of birth, gender, and residential address.

4.It is used for various government welfare programs, subsidies, and services, as well as for identity verification in private and public sector activities.

5.Aadhaar Card is not limited to financial transactions but has wider applications such as obtaining a mobile connection, opening a bank account, availing government schemes, etc.

6.To obtain an Aadhaar Card, individuals need to enroll at an authorized Aadhaar Enrollment Center by providing the required documents and undergoing biometric authentication.

7.Both PAN Card and Aadhaar Card are crucial documents for Indian residents and have different purposes. PAN Card primarily focuses on financial transactions and taxation, while Aadhaar Card serves as a comprehensive identification document for various government and private sector services. It is essential to have both cards to fulfill different requirements in India.

Pan card Aadhar card Link -

Linking your PAN card and Aadhaar card is a mandatory requirement by the Indian government. The process can be done online through the Income Tax Department's e-Filing portal.

Here's how you can link your PAN card and Aadhaar card:

|

| Pan card Aadhar card Link - Pan Aadhar Link Last date - How to Link Aadhar to Pan - if we Not link Pan with Aadhar -pan aadhar link |

1.Visit the Income Tax Department's e-Filing portal at https://www.incometaxindiaefiling.gov.in/.

2.If you have already registered on the portal, log in using your PAN card details. If you are a new user, click on the "Register Yourself" option and follow the registration process.

3.Once you are logged in, go to the "Profile Settings" section and select the "Link Aadhaar" option.

4.Fill in the required details, such as your PAN card number, Aadhaar number, name as per Aadhaar, and the captcha code.

5.Click on the "Link Aadhaar" button to submit the request.

6.If the details provided by you match with the details in the Aadhaar database, your PAN card will be successfully linked with your Aadhaar card.

7.Alternatively, you can also link your PAN card and Aadhaar card through SMS by following these steps:

8.Send an SMS from your registered mobile number in the following format: UIDPAN<SPACE><12-digit Aadhaar number><SPACE><10-digit PAN card number> to 567678 or 56161.

9.If the details provided are correct, your PAN card will be linked with your Aadhaar card.

10.Please note that the process and requirements may change over time, so it's always a good idea to refer to the official Income Tax Department website for the most up-to-date instructions and guidelines.

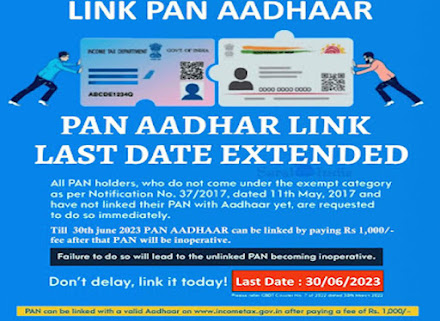

Pan Aadhar Link Last date -

The Last date to link Aadhar with PAN is June 30 2023, & if you are some one who has not Linked Pan Card with Aadhar Card You should do Immediately before the Deadline to Avoid Important Notifications.

According to Income tax Department Press Release In order to Provide some more time to the Tax Payers the Date for Linking Pan With Aadhar to the Prescribed authority for Aadhar Pan Linking without Facing Any Problems.

|

| Pan card Aadhar card Link - Pan Aadhar Link Last date - How to Link Aadhar to Pan - if we Not link Pan with Aadhar - pan aadhar link |

According to the Income tax Website both registered & Unregistered Users Can Link their Pan & Aadhar card on the E-filling Portal - (www.incometax.gov.in) in the Both Pre-log in & Post Log in Mode of Online.

How to Link Aadhar to Pan - if we Not link Pan with Aadhar -

it is mandatory to link your Aadhaar card with your PAN (Permanent Account Number) card in India. The process of linking Aadhaar to PAN is relatively straightforward and can be done in the following ways:

1. Online method:

a. Visit the Income Tax e-Filing website (https://www.incometaxindiaefiling.gov.in/).

b. Look for the "Link Aadhaar" option under the Quick Links section on the left-hand side of the page.

c. Click on "Link Aadhaar" and a new page will open.

d. Fill in your PAN, Aadhaar number, and name as per Aadhaar.

e. If only the year of birth is mentioned on your Aadhaar card, tick the box indicating the same.

f. Enter the captcha code as displayed and click on "Link Aadhaar."

2. SMS method:

a. Type a message in the following format: UIDPAN<space><12-digit Aadhaar><space><10-digit PAN>

For example: UIDPAN 123456789012 ABCDE1234F

b. Send this message to either 567678 or 56161 from your registered mobile number.

3. Sending an SMS to NSDL:

a. Type a message in the following format: UIDPAN<space><12-digit Aadhaar><space><10-digit PAN>

For example: UIDPAN 123456789012 ABCDE1234F

b. Send this message to 567678 or 56161 from your registered mobile number.

Please note that the process and methods may have changed since my knowledge cutoff in September 2021. It's recommended to verify the current process by visiting the official website of the Income Tax department or contacting their helpline for the most up-to-date information on linking Aadhaar to PAN.

What's the Problem Creates If we do not Link PAN With Aadhar -

If you do not link your PAN (Permanent Account Number) with Aadhaar (Unique Identification Number issued by the Indian government), you may encounter several problems:

1.Incomplete Income Tax Returns: Linking PAN with Aadhaar is mandatory for filing income tax returns in India. If you fail to link them, your tax returns may be considered incomplete, leading to penalties and legal consequences.

2.Disruption in Financial Transactions: Non-linking of PAN with Aadhaar can lead to disruptions in financial transactions. For instance, you may face difficulties in opening a bank account, making high-value transactions, or applying for loans or credit cards.

3.Inability to Claim Tax Deductions: Linking PAN with Aadhaar enables the Income Tax Department to verify your identity and track your financial transactions. If you fail to link them, you may not be able to claim tax deductions, exemptions, or benefits available under the Income Tax Act.

4.Invalid PAN: The government has made it mandatory to link PAN with Aadhaar to validate the PAN card. If you do not link them, your PAN card may be considered invalid, making it challenging to use for various purposes like identification, financial transactions, and official documentation.

5.Increased Scrutiny: Non-compliance with linking PAN with Aadhaar can attract increased scrutiny from the Income Tax Department. This may result in the department conducting detailed investigations and audits into your financial activities, causing inconvenience and potential penalties.

6.Missed Government Benefits: Linking PAN with Aadhaar is essential to avail government subsidies, welfare schemes, and benefits. If you do not link them, you may miss out on these benefits, including subsidies for LPG cylinders, scholarships, or other social security schemes.

It is important to note that the specific consequences may vary depending on the policies and regulations in your country or region. The information provided above pertains to the linking of PAN with Aadhaar in India.

If you do not link your Aadhar with PAN till 30th June 2023 as your PAN will Become Inoperative. if your PAN inoperative you have not may be able to furnish intimate or quote your PAN & would be Liable to all Consequences Unde the Act for Such Failure.

This All are Have number of implications such as:

Refund of Any Amount of tax & part thereof, Due under the Provisions of the Act Shall not be made.

Interest shall be not payable on such refund for the period beginning with the date specified under sub rule 4 and ending with the date on which it becomes operative.

Where tax is Deductible under chapter XVIIB in case of Such person such tax Shall be deduct at high rates on the systems with Provisions of Sections of 206AA.

Where tax is Collectible at Source under chapter XVIIB in case of Such person Such tax Shall be Deducted as high Rate In Accordance with Provisions of Section 206CC of Income tax Department.

0 Comments