Business Loan Apply Online - Business Loan Interest rate - Business Loan Eligibility - How to Apply Business Loan

|

| Business Loan Apply Online - Business Loan Interest rate - Business Loan Eligibility - How to Apply Business Loan |

Business Loan

A business loan is a financial product designed to provide capital to businesses for various purposes, such as starting a new venture, expanding operations, purchasing equipment, managing cash flow, or investing in new projects. It is a form of debt financing provided by financial institutions, such as banks or online lenders, to businesses of all sizes.

Business loans typically involve a lender providing a specific amount of money to the borrower, which is then repaid over a predetermined period with interest. The loan terms, including the interest rate, repayment period, and collateral requirements, vary based on factors such as the borrower's creditworthiness, the purpose of the loan, and the lender's policies.

There are different types of business loans available, including term loans, lines of credit, equipment financing, invoice financing, and Small Business Administration (SBA) loans. Each type caters to specific business needs and comes with its own set of terms and conditions.

Before applying for a business loan, it's important for entrepreneurs to assess their financial needs, evaluate the feasibility of repayment, and gather the necessary documentation, such as financial statements, business plans, and credit history. Lenders typically review these factors to determine the borrower's eligibility and evaluate the risk associated with lending.

Business loans can be an essential tool for entrepreneurs to fuel growth, seize opportunities, and manage financial challenges. However, it's crucial to carefully consider the terms, interest rates, and repayment obligations to ensure that the loan aligns with the business's goals and financial capabilities. Consulting with financial advisors or loan specialists can provide valuable guidance in the loan application and decision-making process.

Secured & Unsecured Business Loan

Secured and unsecured business loans are two common types of financing options available to businesses. The main difference between the two lies in the presence or absence of collateral.

1.Secured Business Loan:

A secured business loan is backed by collateral, which is typically an asset or property that the borrower pledges to the lender as security for the loan. If the borrower defaults on the loan, the lender has the right to seize and sell the collateral to recover the outstanding amount. Common forms of collateral include real estate, inventory, equipment, or accounts receivable. Since secured loans carry less risk for lenders, they often offer lower interest rates and higher borrowing limits compared to unsecured loans. These loans are more suitable for businesses that have valuable assets to pledge as collateral.

2.Unsecured Business Loan:

An unsecured business loan does not require collateral. Instead, lenders rely on the creditworthiness and financial strength of the borrower when assessing the loan application. In the case of default, the lender does not have a specific asset to seize as repayment. Unsecured loans are typically smaller in amount and have higher interest rates compared to secured loans. These loans are more accessible to businesses that lack valuable assets or are unwilling to pledge collateral.

Both secured and unsecured business loans have their advantages and considerations:

Advantages of secured loans:

1.Lower interest rates.

2.Higher borrowing limits.

3.Longer repayment terms.

4.Easier to qualify for, even with a lower credit score.

5.Considerations for secured loans:

6.Risk of losing collateral if the loan is not repaid.

7.Longer application and approval process due to collateral evaluation.

8.Generally more suitable for established businesses with valuable assets.

Advantages of unsecured loans:

1.No risk of losing collateral.

2.Faster application and approval process.

3.Suitable for businesses without valuable assets or unwilling to pledge collateral.

4.Considerations for unsecured loans:

5.Higher interest rates.

6.Smaller borrowing limits.

7.May require a stronger credit score and financial history.

When choosing between a secured or unsecured business loan, it's important to consider your business's financial situation, creditworthiness, and willingness to pledge collateral. Additionally, comparing interest rates, repayment terms, and loan terms from different lenders can help you make an informed decision that aligns with your business's needs.

Where to Get Business Loans

There are several places where you can get business loans. Here are some common options:

1.Banks: Traditional banks are one of the most common sources of business loans. They offer various types of loans, such as term loans, lines of credit, and equipment financing. However, banks typically have strict requirements and may require collateral or a strong credit history.

2.Credit Unions: Credit unions are similar to banks but are member-owned and often have lower interest rates and more flexible lending criteria. If you are a member of a credit union, you may be able to secure a business loan through them.

3.Online Lenders: Online lending platforms have become popular in recent years. They offer a convenient way to apply for loans and often have faster approval processes. Some well-known online lenders include Kabbage, OnDeck, and Funding Circle.

4.Small Business Administration (SBA) Loans: The U.S. Small Business Administration provides loans to small businesses through various programs. SBA loans generally have favorable terms and lower interest rates, but they also have strict eligibility requirements and may involve a lengthy application process.

5.Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers directly with individual investors. These platforms can be a good option if you have difficulty obtaining a loan from traditional sources. Examples of peer-to-peer lending platforms include Lending Club and Prosper.

6.Microloans: Microloans are small loans, often under $50,000, offered by nonprofit organizations, community development financial institutions (CDFIs), and some government agencies. These loans are designed to help small businesses and entrepreneurs who may not qualify for traditional bank loans.

7.Angel Investors and Venture Capitalists: If you have a high-growth business or a startup with significant potential, you may consider seeking funding from angel investors or venture capitalists. These individuals or firms invest in promising businesses in exchange for equity or a share of future profits.

It's important to research and compare the terms, interest rates, and requirements of different lenders to find the best fit for your business. Additionally, preparing a strong business plan and financial documentation will increase your chances of securing a loan.

Aspire Instant Business Loan For Self Employed -

Aspire Instant Business Loans is an online lending platform that provides quick and convenient access to business loans for small and medium-sized enterprises (SMEs). Here Build your carrier, Become Eligible for Low cost finance offers, & Earn with extra with referrals.

About Aspire

|

| Business Loan Apply Online - Business Loan Interest rate - Business Loan Eligibility - How to Apply Business Loan |

Inculcates a credit habits & build credit histories to provide lowers income of people & self employed workers. Self employed customers a fair & transparent on their formal financial services journey. we are currently focused on the 100 MM UPI users who are not might quality for a traditional bank credit card. This tack entire bypasses VISA/Master Card/ Rupay & Unable instant Underwriting & transactions on the -22M + QR Code enable merchant as well as Online Merchants

What are the Benefits of using Aspire?

There are Some of Smalls Benefits for the Aspire wants to make Customers life easier.

1. A Healthy Habit : With Aspire began a credit habit. a Clean Repayment history can help you get approved when you apply for a bigger amount letter.

2. No hidden Charges : All fees charged from you will be clearly mentioned by us & reminded to you once your credit is approved. There is a 0% Interest rate, but we do not provide free service. We charge a monthly fixed fees from you and an additional late fees only. if you fail to repay an instalment on time

3. Auto pay : You can start making payments using aspire without the fear of missing out on your repayments deadlines.

Go the cashless way with us -

4. Easy to use - all you need to do to start using and keep using aspire is provide us your correct verifications proofs. you et instant approval and can conclude a transaction with in minutes just Scan & Pay.

Product details

1. Loan product : Term loan for self employed and small business

2. Loan amount range : Rs. 3k to 3L

3. Tenure : 6 to 12 Months

4. Interest rate : 2% to 3.5% per month

5. Processing fees applicable

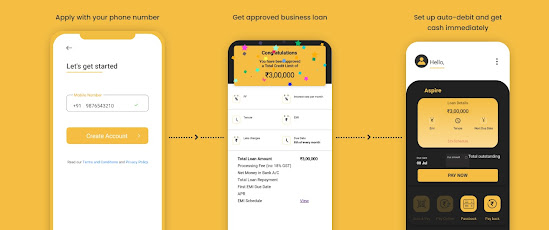

Process

1. 100% Online and Instant process

2. Register and get money in bank account in 10 minutes.

3. Minimum Documentation : Only PAN & Aadhar Number Required

Eligibility Criteria

1. Age : 23 to 50 Years

2. Occupation : Self Employed

3. CRIF Score >= 630

4. Overdue amount < = Rs. 500

5. Zero DPD in the last 6 months

6. No Loan write offs

Target Segment

1. Self employed and small business owner.

2. User is a UPI Merchant.

3. Valid PAN and Aadhar.

4. Android phone (8 and above)

How It Works

|

| Business Loan Apply Online - Business Loan Interest rate - Business Loan Eligibility - How to Apply Business Loan |

Eligibility of Business Loan

To be eligible for a business loan, there are several factors that lenders typically consider. While the specific requirements may vary depending on the lender and the type of loan you are seeking, here are some common eligibility criteria:

1.Credit score: Lenders often evaluate the creditworthiness of the borrower by reviewing their personal and/or business credit score. A higher credit score generally improves your chances of qualifying for a loan and obtaining favorable terms.

2.Business history: Lenders may consider the length of time your business has been operating. Many lenders prefer to work with established businesses that have a track record of revenue and profitability. Startups or newer businesses may find it more challenging to qualify for certain loans.

3.Annual revenue: Lenders will typically want to assess your business's financial health, including its annual revenue or sales. Your revenue demonstrates your ability to generate income and repay the loan.

4.Business plan: A well-prepared business plan that outlines your company's goals, strategies, market analysis, and financial projections can be crucial in demonstrating your business's viability and your ability to repay the loan.

5.Collateral: Some loans, such as secured loans or equipment financing, may require collateral. Collateral can be in the form of business assets, property, or other valuable items that can be used to secure the loan.

6.Debt-to-income ratio: Lenders may evaluate your debt-to-income ratio, which compares your monthly debt obligations to your income. A lower ratio indicates a healthier financial position and may increase your chances of loan approval.

7.Industry and risk assessment: Certain industries may be considered higher risk by lenders, making it more difficult to obtain financing. Lenders may also evaluate the overall risk associated with your business based on factors such as market conditions, competition, and potential for growth.

It's important to note that meeting the eligibility criteria does not guarantee loan approval. Lenders may have additional requirements and evaluate each application on a case-by-case basis. It's advisable to research and compare different lenders to find the one that best suits your business's needs and qualifications.

Business Laon Interest Rate -

The interest rate for a business loan can vary depending on various factors such as the type of loan, the lender, the creditworthiness of the borrower, the loan amount, and the overall economic conditions. Typically, business loan interest rates are expressed as an annual percentage rate (APR).

Here are some general guidelines regarding business loan interest rates:

1.Traditional bank loans: Interest rates for traditional bank loans generally range from around 4% to 13%. However, qualifying for these loans can be more challenging, as banks typically require a strong credit history, collateral, and a solid business plan.

2.Small Business Administration (SBA) loans: SBA loans are backed by the U.S. Small Business Administration and offered through approved lenders. They often have lower interest rates compared to traditional bank loans. The interest rates for SBA loans can range from around 6% to 9%.

3.Online lenders and alternative financing options: Online lenders and alternative financing providers offer business loans with a wide range of interest rates. These rates can start from around 7% and go up to 30% or higher. These lenders often have more flexible eligibility criteria but may charge higher interest rates due to the increased risk.

It's important to note that the specific interest rate you may be offered will depend on your unique circumstances and the lender's evaluation of your creditworthiness and business financials. It's advisable to shop around and compare loan offers from different lenders to find the most competitive interest rate for your business loan.

How to Apply Business Loan

To apply for a business loan online, you can follow these general steps:

1.Determine your loan requirements: Assess your business needs and determine the amount of money you need to borrow. Consider the purpose of the loan, whether it's for working capital, purchasing equipment, or expanding your business.

2.Research lenders: Explore different lenders and financial institutions that offer business loans. Look for lenders that cater to your specific needs, offer competitive interest rates, and have a good reputation.

3.Gather necessary documents: Prepare the required documentation for the loan application. Typical documents include business financial statements, tax returns, bank statements, business plan, identification documents, and any other information the lender may request. Be sure to check the specific requirements of the lender you choose.

4.Visit the lender's website: Go to the website of the chosen lender. Most lenders have an online application process.

5.Fill out the application form: Locate the business loan application form on the lender's website. Fill in all the required fields accurately and completely. Provide detailed information about your business, including its structure, revenue, expenses, and purpose of the loan.

6.Attach supporting documents: Upload the necessary supporting documents as requested by the lender. Ensure that all documents are properly scanned or saved in a compatible file format.

7.Review and submit the application: Review the completed application and attached documents for accuracy and completeness. Make any necessary corrections before submitting the application.

8.Submit the application: Once you are confident that the application is accurate and complete, submit it through the online application portal. Some lenders may also require you to mail or fax the supporting documents.

9.Wait for a response: After submitting the application, wait for the lender to review it. They may contact you for additional information or clarification if needed.

10.Receive a loan offer: If your application is approved, you will receive a loan offer from the lender. Carefully review the terms and conditions, including interest rates, repayment schedule, and any associated fees.

11.Accept the loan offer: If you agree with the loan terms, follow the lender's instructions to formally accept the loan offer. This may involve signing an agreement or electronically accepting the offer.

12.Receive the funds: Once you have accepted the loan offer, the lender will initiate the process of disbursing the funds. The timeline for receiving the funds may vary depending on the lender.

Remember that the specific steps and requirements may vary depending on the lender and the country in which you operate. It's essential to thoroughly research and understand the terms and conditions of the loan before accepting any offer.

0 Comments