How to Get Vehicle Loan From Bank - Vehicle Loan Interest rate - Vehicle Loan Apply Online - Loan Against Vehicle Online

|

| How to Get Vehicle Loan From Bank - Vehicle Loan Interest rate - Vehicle Loan Apply Online - Loan Against Vehicle Online |

What is Vehicles?

Vehicles are means of transportation designed to carry people or goods from one place to another. They come in various forms and are used for different purposes, including personal transportation, public transportation, commercial transportation, and industrial applications.

Vehicles can be categorized into several types based on their mode of propulsion and design. Here are some common types of vehicles:

1.Cars: Automobiles designed for personal transportation on roads. They are typically powered by internal combustion engines (gasoline or diesel) or electric motors.

2.Trucks: Vehicles used for transporting goods. They come in various sizes and configurations and are commonly powered by diesel engines.

3.Buses: Vehicles designed for public transportation, capable of carrying a large number of passengers. They can run on various fuels, including diesel, gasoline, or natural gas.

4.Motorcycles: Two-wheeled vehicles powered by internal combustion engines or electric motors. They are commonly used for personal transportation, especially in urban areas.

5.Trains: Vehicles that run on tracks and are used for passenger transportation or freight transport over long distances. They can be powered by electricity, diesel, or other fuel sources.

6.Ships: Watercraft designed for navigation in oceans, seas, rivers, or lakes. They vary in size and purpose, including cargo ships, cruise ships, and naval vessels.

7.Aircraft: Vehicles designed for air travel. They include airplanes, helicopters, and drones, and can be used for passenger transport, cargo transport, or military purposes.

8.Bicycles: Human-powered vehicles with two wheels. They are commonly used for personal transportation, exercise, and recreational purposes.

9.Construction and industrial vehicles: Vehicles specifically designed for construction sites, mining operations, or other industrial applications. Examples include bulldozers, excavators, forklifts, and dump trucks.

Read also - Home Loan Apply Online

These are just a few examples, and there are many other types of vehicles tailored to specific purposes and environments. The development of electric and autonomous vehicles is also gaining momentum, introducing new technologies and possibilities in the field of transportation.

Vehicle Loans & Insurance -

1.Insurance -

Vehicle insurance: Vehicle insurance refers to a type of insurance coverage that provides financial protection against damages, losses, or liabilities associated with owning or operating a vehicle. It helps mitigate the financial risk of accidents, theft, or damage to the insured vehicle.

Please note that these are general definitions, and the specific terms and coverage may vary depending on the insurance policy and jurisdiction. It's always important to refer to the actual insurance policy and consult with an insurance professional for detailed and accurate information.

2.Loans -

Vehicle loans, also known as auto loans or car loans, are financial arrangements that allow individuals to purchase a vehicle by borrowing money from a lender. These loans provide a convenient way for people to acquire a vehicle without having to pay the full purchase price upfront. Instead, the borrower repays the loan amount in installments over a specified period, typically ranging from two to seven years.

Let us Now We have Discussed Now for Vehicle Loans Policy & What was its Features

Vehicles & Auto Loans -

Vehicle loans, also known as auto loans or car loans, are a type of financial arrangement that allows individuals to purchase a vehicle by borrowing money from a lender. The borrower then repays the loan amount, plus interest, over a specified period of time through regular monthly installments.

Here are some key points to understand about vehicle loans:

1.Lenders: Vehicle loans are typically offered by banks, credit unions, and other financial institutions. Dealerships may also provide financing options through partnerships with lending institutions.

2.Loan Terms: The loan term refers to the length of time over which the borrower is expected to repay the loan. Loan terms for vehicle loans commonly range from 24 to 84 months (2 to 7 years). Shorter loan terms result in higher monthly payments but less interest paid over the life of the loan.

3.Interest Rates: The interest rate is the cost of borrowing money and is usually expressed as an annual percentage rate (APR). The interest rate on a vehicle loan can vary based on factors such as the borrower's credit history, loan term, and the prevailing market conditions.

4.Down Payment: A down payment is an initial upfront payment made by the borrower when purchasing a vehicle with a loan. It is typically a percentage of the vehicle's total cost. A larger down payment can help reduce the loan amount and lower monthly payments.

5.Vehicle Ownership: While the borrower uses the vehicle, the lender holds a lien on it as collateral until the loan is fully repaid. Once the loan is paid off, the lien is released, and the borrower becomes the sole owner of the vehicle.

6.Creditworthiness: Lenders evaluate the creditworthiness of borrowers by considering factors such as credit score, income, employment history, and existing debts. A higher credit score generally results in better loan terms, including lower interest rates.

7.Loan Approval Process: To obtain a vehicle loan, borrowers typically submit an application providing personal and financial information. The lender assesses the application, including credit checks, and makes a decision on loan approval. Pre-approval is also possible, allowing borrowers to know their budget before vehicle shopping.

Read also -Pan Card Aadhaar Card Link

It's important to carefully consider your financial situation and compare loan offers from different lenders before committing to a vehicle loan. Reading the terms and conditions, understanding the interest rates, and calculating the total cost of the loan over its term can help you make an informed decision.

How to Get Vehicle Loan From Bank

To get a vehicle loan from a bank, you can follow these general steps:

1.Determine your budget: Assess your financial situation and determine how much you can afford to borrow for a vehicle loan. Consider your monthly income, expenses, and other financial obligations.

2.Research loan options: Explore different banks and financial institutions to find the best loan options for your needs. Compare interest rates, repayment terms, and any additional fees or charges associated with the loan.

3.Check your credit score: Request a copy of your credit report and review your credit score. Banks often consider credit scores when approving loan applications. A higher credit score can improve your chances of getting a loan and may lead to more favorable terms.

4.Gather necessary documents: Prepare the required documents for the loan application process. These documents typically include proof of identity, proof of income (such as pay stubs or tax returns), proof of address, and vehicle-related documents (such as purchase agreement or vehicle details).

5.Approach the bank: Visit the bank or contact them to inquire about their vehicle loan application process. You can schedule an appointment with a loan officer to discuss your loan requirements and understand the specific documentation and procedures they require.

6.Complete the application: Fill out the loan application form provided by the bank. Provide accurate and complete information regarding your personal details, employment history, income, and any other information required. Double-check the form for any errors or missing information before submitting it.

7.Provide necessary documentation: Submit all the required documents along with your loan application. Ensure that you have copies of the documents for your records.

8.Wait for approval: The bank will review your application and documents. This process may take some time, so be patient. The bank may also conduct a background check and verify the information provided.

9.Loan approval and terms: If your loan application is approved, the bank will provide you with the loan approval letter and specify the terms of the loan, including the interest rate, repayment period, and any other conditions.

10.Complete the loan agreement: Read the loan agreement carefully, including all terms and conditions. If you agree to the terms, sign the agreement and submit it to the bank.

11.Vehicle purchase: Once the loan agreement is signed, the bank will disburse the loan amount to either you or the seller, depending on the agreement. You can then complete the purchase of the vehicle.

12.Repay the loan: Make timely monthly payments as per the agreed-upon repayment schedule. Ensure that you understand the repayment terms and set up automatic payments or reminders to avoid missing any payments.

Remember, the specific process and requirements may vary depending on the bank and your location. It's always recommended to consult with the bank directly to get accurate and up-to-date information about their vehicle loan process.

Eligibility of Vehicle Loans -

Vehicle loans, also known as auto loans or car loans, are financial products offered by banks, credit unions, and other financial institutions to help individuals purchase vehicles. The eligibility criteria for vehicle loans can vary depending on the lender and the specific loan terms. However, I can provide you with a general overview of the common factors that lenders consider when determining eligibility for a vehicle loan:

Credit Score: Lenders typically evaluate your creditworthiness by reviewing your credit score and credit history. A higher credit score demonstrates a good repayment history and lowers the risk for the lender. Generally, a higher credit score improves your chances of getting approved for a vehicle loan and may also qualify you for more favorable interest rates.

Income and Employment: Lenders assess your income level and stability to ensure that you have the financial capacity to repay the loan. They may require proof of income, such as recent pay stubs or income tax returns. Generally, a steady employment history and a higher income can increase your chances of loan approval.

Down Payment: Providing a down payment can be a requirement for vehicle loans. The down payment amount is typically a percentage of the vehicle's purchase price. A larger down payment can help reduce the loan amount and may positively influence the lender's decision.

Debt-to-Income Ratio: Lenders also evaluate your debt-to-income ratio, which compares your monthly debt obligations (such as mortgage payments, credit card payments, and other loan payments) to your monthly income. A lower debt-to-income ratio indicates a lower risk for the lender and can improve your eligibility for a vehicle loan.

It's important to note that these factors are not exhaustive, and different lenders may have additional criteria or variations in their eligibility requirements. Additionally, loan terms and conditions can vary based on the type of vehicle being financed (new or used) and the specific lender's policies.

When considering a vehicle loan, it's advisable to research different lenders, compare interest rates and terms, and contact the lender directly to inquire about their specific eligibility criteria and requirements.

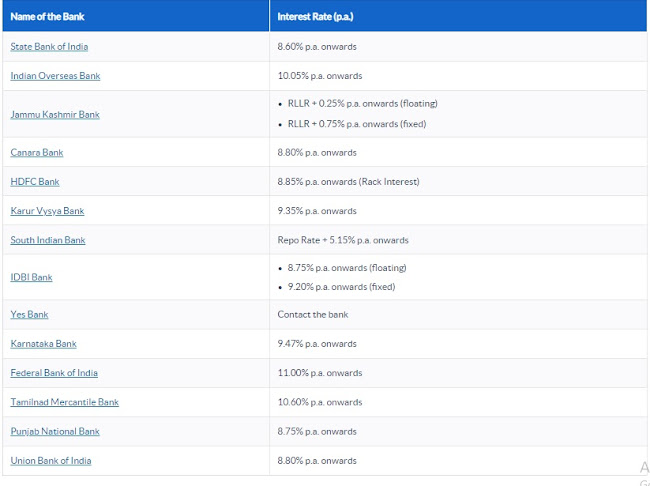

Vehicle Loan Interest rate

There are Several Lenders who offers Car & Vehicles Loans from India. The Interest rate For the Car Loans in India start at as Low as 8.60% p.a Based on your Credit ratings you can available for a Car Loans which is finance up to 100% on the Road Price of the car &Vehicles Loans.

|

| How to Get Vehicle Loan From Bank - Vehicle Loan Interest rate - Vehicle Loan Apply Online - Loan Against Vehicle Online |

Vehicle Loan Apply Online (Loan Against Vehicle Online) -

To apply for a vehicle loan online, you can follow these general steps:

1.Research and compare lenders: Look for reputable lenders that offer vehicle loans and compare their interest rates, loan terms, eligibility criteria, and customer reviews.

2.Visit the lender's website: Once you have chosen a lender, visit their official website to begin the application process.

3.Navigate to the loan application page: Look for a section on the lender's website specifically for vehicle loans or personal loans.

4.Start the application: Click on the "Apply Now" or similar button to begin the loan application. You may need to create an account or provide your contact information to proceed.

5.Fill in the required information: Complete the online application form with accurate details. This information typically includes personal details (name, address, date of birth), employment details (income, employer information), and vehicle details (make, model, year).

6.Provide supporting documents: The lender may require additional documentation to verify your identity, income, and employment. These documents may include ID proof, address proof, income proof (pay stubs, bank statements), and sometimes vehicle-related documents (like a copy of the vehicle registration).

7.Review and submit the application: Double-check all the information you have provided and make any necessary corrections. Once you are confident that everything is accurate, submit your application.

8.Await the lender's decision: The lender will review your application and assess your eligibility for the loan. This process may take some time, depending on the lender's internal procedures.

9.Loan approval and terms: If your application is approved, the lender will send you an offer detailing the loan amount, interest rate, repayment term, and any other relevant terms and conditions.

10.Accept the loan offer: Carefully review the loan offer and make sure you understand all the terms and conditions. If you agree to the terms, you can accept the offer either by signing the loan agreement electronically or following the lender's specified instructions.

11.Receive the funds: After accepting the loan offer, the lender will typically transfer the loan amount directly to your bank account. The time it takes for the funds to be disbursed can vary depending on the lender and your bank.

Remember, these steps are general guidelines, and the specific process may vary depending on the lender and their online application system. It's important to read the lender's instructions carefully and provide accurate information to increase your chances of loan approval.

0 Comments